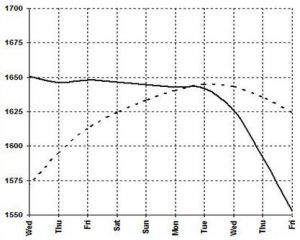

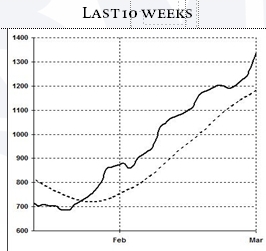

Trends are ascendant for the Capesizes for the first time in nearly two weeks with average rates up by 4-5% at midweek. There is said to be more action below the surface with a likelihood of more fixtures by the afternoon. For now, Pacific ore voyages are the main deals with Dampier/Qingdao steady at US$ 6.2/mt on tonnage of 170,000mt. The Pacific round for Capesizes jumped US$ 700 to US$ 13,000 via Japan. TARVs grain US$ 250 to reach US$ 11,500 daily via Continent where general sentiment is lightly buoyant.

Panamax activity has grown modestly on the Continental front haul into the middle US$ 13,000s, but the market itself remains broadly flat. Trans-Atlantic rounds have stabilized at about US$ 7,250 daily but are under pressure with a downside. South America, some brokers say, is returning to the market as grain purchasing resumes, thus boosting front haul trades. The ECSA Kamsarmaxes to NoPac are securing APS rates near US$ 12,000 daily plus US$ 500,000 BB.

Modest indications of recovery in the Atlantic at the start of the week start to build some momentum in Handy bulk markets by midweek on signs that USG front hauls are on the way back up as upwards of US$ 20,000 daily is secured to CJK on 58,000 dwt ships. Also from the USG, trans-Atlantic trips to the Continent have also been showing signs of improvement with middle teens of up to US$ 15,000 daily obtainable on Ultramaxes on UKC-Med redelivery, sources report. The South American exports are still sporadic with some brokers describing the market as “catch as catch can” given the lack of consistent trend from the ECSA agri-prod spot markets. At any rate, Handysizes of 32,000 dwt have been securing lower teens of US$ 12,500 daily from ECSA into the Far East, we are told, which is a significant upgrade from last week. Then again, we also hear that pressure is growing on this run with one Supra recently unable to secure anything higher than US$ 12,000 DOP.

…continue reading in today’s BMTI Daily Report.

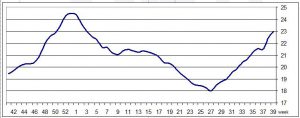

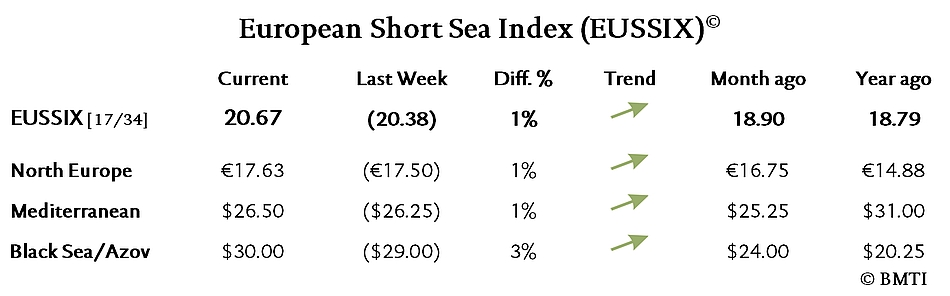

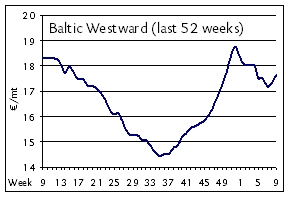

The spot market remains tilted toward owners with activity still holding to higher-than-average levels in the northern trades of the Baltic Sea and North Sea coaster routes. But with rates still not demonstrably higher than they were 2-3 weeks ago, there is also little basis to call it a rally of the kind clearly taking place across the Atlantic Handy bulk sector. UK exports to North Spain are sporadic—as strike conditions at Spanish ports have slowed trade—with rates in the range of EUR 14-17/mt, interestingly with delivery WCUK on the lower end and ECUK on the higher end of that range on parcels of 4-5,000mt. Westward trips from ARAG to WCUK are fixing up to EUR 15/mt and closer to EUR 13-14/mt on ECUK redel. Among all the northern trade regions, the Baltic Sea is still the strongest in terms of supply-demand gap with just a slight increase in demand from present levels likely to set off the long-desired freight hike that shipowners have been predicting. Tonnage is decidedly less tight in the Irish Sea and North Sea, though charterers are having no success in pushing freights any lower than last-done levels with westward redelivery to Ireland from the German Baltic getting EUR 15/mt and rumoured to be fixing up to EUR 15/mt on 5,000mt parcels. Better weather seems to have been a modest boon to owners with charterers more willing to put cargoes on the market without the risk of having them tied up at port due to stormy conditions. Earnings have been generally unchanged on standard trans-Baltic shipments with 3-4,000 dwt ships still getting mid EUR 2,000s of about EUR 2,400-2,600 daily on non-ice class tonnage. Most owners remain optimistic about March with trends among the deep-sea bulkers also providing some encouragement, however indirect.

The spot market remains tilted toward owners with activity still holding to higher-than-average levels in the northern trades of the Baltic Sea and North Sea coaster routes. But with rates still not demonstrably higher than they were 2-3 weeks ago, there is also little basis to call it a rally of the kind clearly taking place across the Atlantic Handy bulk sector. UK exports to North Spain are sporadic—as strike conditions at Spanish ports have slowed trade—with rates in the range of EUR 14-17/mt, interestingly with delivery WCUK on the lower end and ECUK on the higher end of that range on parcels of 4-5,000mt. Westward trips from ARAG to WCUK are fixing up to EUR 15/mt and closer to EUR 13-14/mt on ECUK redel. Among all the northern trade regions, the Baltic Sea is still the strongest in terms of supply-demand gap with just a slight increase in demand from present levels likely to set off the long-desired freight hike that shipowners have been predicting. Tonnage is decidedly less tight in the Irish Sea and North Sea, though charterers are having no success in pushing freights any lower than last-done levels with westward redelivery to Ireland from the German Baltic getting EUR 15/mt and rumoured to be fixing up to EUR 15/mt on 5,000mt parcels. Better weather seems to have been a modest boon to owners with charterers more willing to put cargoes on the market without the risk of having them tied up at port due to stormy conditions. Earnings have been generally unchanged on standard trans-Baltic shipments with 3-4,000 dwt ships still getting mid EUR 2,000s of about EUR 2,400-2,600 daily on non-ice class tonnage. Most owners remain optimistic about March with trends among the deep-sea bulkers also providing some encouragement, however indirect.