Settling from last week’s minor uptick in activity and sentiment—perhaps buoyed by increasing bunker prices as well—rates for northern ships have settled back into their historical sideways motion as owners continue to keep a hard line at operating costs, which is where rates continue to hover dangerously just above. Market dynamics are undeniably poised against owners at the moment, as they have been for most of the year, with open tonnage just plentiful enough in most areas of trade to keep charterers from feeling any urgency to fix on forward positions or give premium rates unless absolutely necessary. With the onset of summer sluggishness and widespread holiday-taking across northern and western Europe, there is little hope for a recovery in the short term. Whether July brings a new wave of demand, inspired by a return of grain from the southern European markets as the Black Sea harvest starts, remains yet to be seen.

Despite slowing in upward momentum, Capesize voyages do not appear to have hit a wall yet with modest improvements taking Brazil/ARAG voyage rates toward US$ 8.4/mt and Brazil/China toward US$ 18.5/mt. Whether they will keep rising over midweek is another issue, brokers strain to remind. Pacific RVs seem to be the first rates to buckle under the pause in demand with a flat and even rate of US$ 17,000 daily the newly downgraded (if just slightly downgraded) level for 180,000mt cargoes. The Atlantic spot basin, by comparison, is still going strong with a surprisingly robust US$ 1,000 upgrade on Tuesday taking average freights over US$ 19,000 and suggesting US$ 20,000 daily on the horizon.

The Panamaxes‘ day in the sun seems to have arrived after several weeks of suffering pressure on rates and less-than-spectacular sentiment. The upturn is most notable within the western hemisphere where owners are already seeking long haul rates at US$ 1,000 premiums to what they were asking for at the end of last week. A case in point is the trans-Atlantic round voyage from the Continent, which can now fetch upper US$ 8,000s daily on modern tonnage after settling for anything in the US$ 7,000s less than a week before. Pacific business is back in action as well with NoPac rounds pushing toward US$ 9,000 daily on standard tonnage to Singapore.

Russia said it will begin enforcing regional quotas and limiting its exports of ferrous scrap beyond the Eurasian Economic Union (EEU) starting in July and continuing for the six months thereafter. Further, starting next year, Russia says it will be handling scrap exports exclusively with an exchanged-based tender process. A bill in support of the new measures is expected to be introduced in September. The quotas will involve a series of specific coefficients to be assigned to each region in proportion to the shortage of ferrous scrap in the region. The lowest coefficient of 0.5 will be applied to Russia’s southern regions while the highest (1.5) will be set for Arkhangelsk. How this will effect scrap shipments within Europe is yet to be seen, especially for Turkey, the world’s top scrap importer. Turkey’s imports of shredded ferrous scrap, at any rate, have increased considerably in June so far with new data showing that Turkish mills bought 238,500mt of shredded scrap—comprising 15 single cargoes—since the start of June, which is more than twice the volume purchased by Turkey for the entirety of May (108,500mt). Scrap market observers speculate this increase in shredded steel imports to Turkey reflects a desire to build scrap stocks at presently favourable prices rather than in response to any growth in demand for domestic steel production.

The chartering market is still looking for direction and seems at odds to find it. An abysmally poor rate of US$ 7,000 daily from the Baltic via Continent was reported done an Ultramax open in the Baltic. Steel operators were predicting a flurry of fresh orders off the Continent for Handysize tonnage and have already fallen prey to this forecast by getting in tonnage of 30-38,000 dwt for a trip from the Continent-US-NCSA range at US$ 8,000-9,000 daily. Swire are still open to cover an Ultramax from the Continent to Brazil after they failed to look at one at US$6,500 daily, which is gone now. For a quick local employment for Supramax tonnage charterers were thinking along the lines of US$ 5-6,000 daily, which one Ultra owner would not do below US$ 10,000 daily. Nut coke charterers were seeing 37,000 dwt tonnage at the daily equivalent of below US$13,000.

Copenhagen-based bulk carrier operator Baltnav reports that it secured a profitable 2018, which has allowed it to expand globally with plans to open a new office in Brazil as well as new forays into ship management. The company’s net profit jumped to US$ 4.2m in 2018, solid performance for a company dealing exclusively in smaller sized Ultra-Supra-Handy bulk vessels. Baltnav, which operates a fleet of 47 vessels from Ultramax to Handysize types, employs a business model focused on extremely short charter contracts, typically only from one to three months of period trading. Nearly half the fleet is chartered for single sailings while a small percentage is secured on longer 12-month period contracts. Continuing with this model, the company says that it expects to secure a profit in 2019 as well, although most likely falling below last year’s levels.

Necessity is the mother of invention, as they say, and this year’s challenging dry bulk market has seen quite a bit in the area of invention among owners seeking new ways to combine forces. This week, three Hamburg-based companies—Bertling, Nordic Hamburg and Oskar Wehr—announced plans for a new joint venture called OneBulk, intended to start operations in Hamburg and Singapore at the beginning of July. The combined fleet of the owner-operators would amount to about 50 vessels ranging from the Handysize to Kamsarmax sizes. In a statement, OneBulk said, “the partners will share their know-how and expert teams to leverage the best of all three companies and provide comprehensive commercial management solutions and associated services to vessel owners, charterers and investors.” The pool is open to new partners that can provide competitive solutions and “maximum flexibility”.

The recent Capesize rally—which has seen freights return to January levels enjoyed before the Brazil mine disaster and its related freight crisis—came to a pause at the resumption of business this week with few major changes seen either up or down, but some worrying corrections on the trans-Pacific RV. The Pac RV had been rising rather rapidly in recent days, only to see a sharper reversal of some US$ 300 (the strongest of all routes) in its assessment to settle in the US$ 17,000s. Another day of trading will likely indicate whether this is a speed bump or the end of the most recent recovery cycle. For now, with new fixtures lacking, the latter option seems most likely. A stretch of noncommittal days from charterers has left the Panamax markets high and dry at this stage of the month of June with owners left to hustle to find employment in a newly unsure market. TARVs have started to turn downward more quickly than in day past with the US$ 8,000s having already collapsed to the US$ 7,000s and trends suggesting that US$ 6,000s are not impossible before the week is over. Front hauls have also slowed with US$ 17,000 daily about the best that an ex-Continent trip can fix.

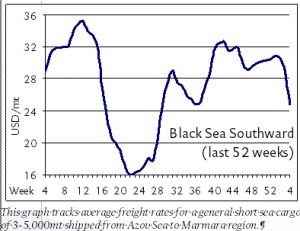

Increased coal movements around the Sea of Azov have helped buoy sentiment and rates to a limited degree, at the very least halting the slow decline seen in recent weeks. And amid the dominant sideways trend, there is word of some even fixing slightly higher levels over last-done as charterers prove willing to pay premiums for early June dates. Rising activity for scrap and coal shipments in the Black Sea and Sea of Azov comes as an encouraging trend for owners, who remain nonetheless sceptical about how much uplift this activity can or will provide. Azov to Marmara shipments continue to fix high teens of US$17-18/mt on 5,000mt (46′) grain. Coal is fixing similar rates on this run. Inter-Black Sea grain ex-Novo to Marmara are at US$ 15-16/mt.

Get news and updates from the European short sea market by subscribing to the BMTI SHORT SEA REPORT today.

Again taking a turn back toward the positive, rate trends ended up flatter than the week before, if only because the positive and negative movements were more uniformly distributed among various trade routes. On the whole, according to the Shanghai Containerized Freight Index, rates only declined by a minimal 0.3% on average even as some rates saw significant gains ex-Shanghai such as rates to PG, which rose 7.5% week-on-week to US$ 657/TEU while others saw considerable declines such as those to South America, which were down 9.5% on the week to US$ 803/TEU. These extreme points of departure notwithstanding, the market for containership freights behaved rather timidly over the past week with no more than 3% up or down seen on the majority of freights, the aforementioned excepted. On the buoyant end (after PG redelivery) shipments to Europe saw nearly 3% improvement (up 2.8%) on the week to close at solid levels of US$ 743/TEU while Mediterranean redelivery enjoyed upgrades of 2.0% week-on-week to settle at US$ 710/TEU. On the negative side of things, rates to the USWC and USEC fell by 3.4% and 2.2% on the week to US$ 1,294/TEU and US$ 2,540/TEU, respectively, while rates from Shanghai to East-West Africa also declined by about 2.4% week-on-week to close within the range of US$ 2,554/TEU.

NASDAQ-listed owner-operator Pangaea Logistics Solutions [PANL] says it plans to offer shareholders a quarterly dividend for the first time since going public in 2014. The US bulk carrier firm says it will pay US$ 0.035 from 11 June. CEO Ed Coll said the company had a proven business model and that after reinvesting profits in operations, Pangaea expected to become a leading “growth and income” company that cares about enhancing shareholder value. The company says it has managed to stay profitable, despite the ongoing dry bulk crisis, by offering logistical solutions to industrial clients with its owned and chartered-in fleet. Pangaea boasted income of US$ 3.7m against revenues of US$ 79.5m in Q1-2019.

Greek owners are said to be little nervous about 2020 with the upcoming challenge to meet the now sulphur cap standards. Some believe this could lead to a three or four-tier market. The uncertainty is worrying them without doing too much about it. The Atlantic chartering market is lacking momentum, whilst South Africa is flourishing and of course the South American area is still being dominated by Kamsarmax demand, whilst other sizes are trailing. Off the Continent, voyage rates for local trading are equivalent to US$ 9,000 daily for Ultramax vessels. Scrap charterers were seeing US$ 15-16,000 daily for a trip to Bangladesh which sounds unrealistic. Handysize freight rates have been about holding with a 32,000 dwt fixed into the central Med in the region of US$ 9,500 daily with delivery in the Baltic. The dearth of inquiry from Med-Black Sea is keeping rates at pretty low levels. On the other hand, achieving the equivalent of US$ 11,000 daily on a 62,000 dwt from West to East Med is not to be sniffed at.

Having had a relatively beneficial week, Capesizes start to flatten as the week ends with owners hoping that sentiment stays in their corner with trends moving sideways and some already trending downward. Front haul trips seem to have already peaked with the mid US$ 20,000s moving back into the US$ 24,000s and Pacific RVs into the US$ 11,000s. With Vale’s output very much in question and US-China trade conflicts at the fore, it remains to be seen what May has to give for this most volatile of bulk carrier sectors. But owners remain optimistic as ever. Panamaxes continue to enjoy their day in the sun with solid improvements on all freights observed across the board and charterers reluctantly giving premiums over last-done levels on nearly every rate. Front hauls that were getting low US$ 17,000s early in the week are now commanding high US$ 17,000s and even as much as US$ 18,000 daily in some cases. With little reason to do otherwise, Supramax owners are pushing for generously improved rates on all freights coming from the USG as more than US$ 12,000 daily has been observed on freights to the Continent and US$ 18,000 on front hauls with NoPac redelivery. The rest of the market is less buoyant by comparison, but owners are undoubtedly inspired to seek higher freights on nearly every rate.

To read shipbroking analysis like this every day, subscribe to the BMTI Daily Report.

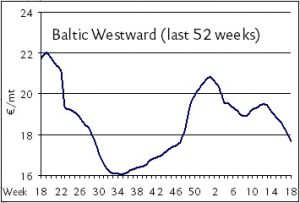

Declines in freights seem to have started to accelerate as the days of May lengthen with the lingering impact of holiday-strewn weeks having the expected braking effect on business activity in general. Charterers have given up trying to play nice for the time being as owners note a more aggressive attempt to push freights to new lows. Cargo demand, despite being promised to return in earnest after Q1, remains less than spectacular, to put it nicely. Even for a European coaster market that has seen very little tonnage expansion in recent years, and one that remains thankfully tightly-bound to cargo demand, the wide availability of tonnage is undeniable. High teens that were tracked for most of the year on the westward Baltic route—from Balticum to ARAG—in the range of EUR 18-20/mt are now moving toward EUR 16-17/mt and lower, brokers report. Longer runs from the German Baltic to WCUK are looking at mid-low EUR 20s/mt of about EUR 23-25/mt, depending on terms. This remains true, although traders are already assuming the same business will be going for EUR 22-23/mt by the end of the month. The reverse trip from WCUK to the lower Baltic is seeing 3,000mt general cargoes fix middle teens of EUR 14-15/mt.

Declines in freights seem to have started to accelerate as the days of May lengthen with the lingering impact of holiday-strewn weeks having the expected braking effect on business activity in general. Charterers have given up trying to play nice for the time being as owners note a more aggressive attempt to push freights to new lows. Cargo demand, despite being promised to return in earnest after Q1, remains less than spectacular, to put it nicely. Even for a European coaster market that has seen very little tonnage expansion in recent years, and one that remains thankfully tightly-bound to cargo demand, the wide availability of tonnage is undeniable. High teens that were tracked for most of the year on the westward Baltic route—from Balticum to ARAG—in the range of EUR 18-20/mt are now moving toward EUR 16-17/mt and lower, brokers report. Longer runs from the German Baltic to WCUK are looking at mid-low EUR 20s/mt of about EUR 23-25/mt, depending on terms. This remains true, although traders are already assuming the same business will be going for EUR 22-23/mt by the end of the month. The reverse trip from WCUK to the lower Baltic is seeing 3,000mt general cargoes fix middle teens of EUR 14-15/mt.

The decent handful of new TCs that came through for the Capesizes at midweek were not repeated by the end of the week, but no bother. Sentiment has been sufficiently triggered to start rising once again as the long-delayed requirements of the holiday period seem to be again entering the spot market with employment enquiries being reported by owners in the Atlantic and Pacific alike. Front hauls have been broadly upgraded with as much as US$ 23,500 daily on offer for standard tonnage from the Continent into the CJK area. Voyage rates enjoy another boost as well with Brazil/China climbing back over the US$ 15/mt marker with some owners already claiming to have US$ 16/mt on lock for end-May.

Perhaps inspired by the same gust of wind that has lifted the Capes—not to mention a new sense of purpose in the East—Panamax freights are firming a little bit faster, suggesting potential for a real recovery by next week, assuming trends hold steady. Front hauls have been getting fixed in the mid US$ 17,000s we are told, though this run is still too little frequented to make a fair assessment. Aussie rounds are pushing toward US$ 10,000 on Kamsarmaxes.

Improvements build for Supramaxes on Black Sea delivery with front hauls said to be hovering under US$ 13,000 daily on modern ships. Trans-Atlantic trades ex-USG remain problematic, but minerals on Tess 58s are securing steady rates of US$ 11,000 and up on UKC-Med redelivery with talk of US$ 11,500 on the horizon for the same business. Indo rounds are onwards and upwards with Supramax tonnage having set the new high water mark at US$ 9,500.

To read shipbroking analysis like this every day, subscribe to the BMTI Daily Report.

Impairments on credit for shipping and petroleum investments of Danske Bank fell in the first quarter of the year, according to the Danish bank’s newest interim report. Loan impairment charges saw a “significant reduction” in the quarter against loan exposures to the industries of shipping, oil and gas, said the report, noting that high reversals were especially seen in the area of Norwegian shipping, oil and gas. Net reversals of DKK 48m in total in the quarter were described as a “very low level” of impairment charges for the bank, according to the report, though these industries remain a “focus area” considering that the shipping market has had a “slower pickup” than was expected. Danske Bank’s Stage 1 gross exposure to shipping, oil and gas was at DKK 41.6m in the quarter, down from DKK 43.9m in Q4-2018.

Recent rainfall in Western Europe has boosted output forecasts for the EU wheat crop, though analysts warn that more rain will be required to avoid potential crop damage from drought. Forecasters remain positive for EU wheat as increased sowings and more favourable weather conditions this year (including a mild winter) suggest that output could return to normal after last year’s drought-afflicted harvest. The official forecast for EU common wheat production in the 2019-20 season was raised to 141.3 Mt this week, putting it a full 10% above last year’s output.

Capesize freights rose by as much as 38% last week, according to some metrics, with the recover in sentiment buoyed by the reopening of Vale’s Brucutu iron ore mine in Brazil and very strong voyage activity in the Pacific. With over 80% of bulk carrier trade said to be linked to iron ore (also, according to some metrics), the oversized influence of this commodity on the bulker trades can scarcely be underestimated. Rates have continued to climb as business resumed this week after the weekend, usually a sign of a bullish market, with TARV rates moving into the US$ 9,000s and Pacific round voyages climbing into the low teens of US$ 10-11,000 daily. Front hauls have already been fixing low US$ 20,000s of up to US$ 22,000 daily, according to some brokers’ reports, with shipowners having regained the control in negotiations for the first time in many weeks. These higher levels are nonetheless precarious, traders warn, as sentiment-driven as the Cape market is, another snap in geopolitical events could send rates tumbling as fast as they climbed in the final week of April. Owners hope that market fundamentals will solidify (as open tonnage tightens up) to keep this from happening.

After Easter break, one can’t but conclude that still not much is going on. The market in general remains pretty disappointing without any immediate ray of hope. Even though some brokers report a flurry of activity, others keep talking of a market trudging along. Indeed, the numbers talked and reported indeed suggest the latter. Off the Continent, Ultramaxes are being fixed in the low US$ 8,000s for a short local employment. The owners of a 56,000 dwt vessel have been seeing US$ 9,000 daily from scrap charterers for a trip to the East Med. Handy rates have been equally disenchanting with a 38,000 dwt booked for a Baltic round voyage with delivery Rotterdam at a rate of US$ 6,500 daily. The Black Sea remains a “graveyard” for the owners. Ultra-Supramax owners prefer to ballast away instead of taking front hauls of US$ 11-12,000 daily.

Adriatic Sea market: Traffic has been sporadic at best. Ammonium nitrate of 1,000mt has secured US$ 39-40/mt from Alexandria to Sarande (Albania). Steels of 1-2,000mt have fixed high US$ 30s/mt of up to US$ 37-38/mt ex-Nemrut to Split, brokers say. Standard grains of 5,000mt (46′) are being done from Yeisk into the Italian Adriatic at US$ 35/mt.

Turkish Med: As usual, import shipments to the Turkish Med have been considerable and trade has been steady in Q2 thus far. Fertilizers (urea) of 5-6,000mt have been routinely securing upwards of US$ 15/mt into Antalya from Damietta (and elsewhere in Egypt). Grains of 5,000mt (46′) ex-Novorossiysk to Mersin are being fixed at US$ 23-24/mt. Steels (2,000mt) from Iskenderun to Constanta have been reportedly concluded at about US$ 26-27/mt.

Operator Western Bulk Chartering announced that it has secured new debt financing and intends to raise US$ 15m in equity, ensured by its two main shareholders, in order to “support further growth” and strengthen its financial platform, said CEO Jens Ismar. The bond of US$ 35.1m (and US$ 31.74 outstanding) will be repaid in full, according to a statement from the company. WBC made an after-tax profit of US$ 4.2m last year, but suffered a big write-off in the second half of the year (US$ 10m) due to ill-timed time charter contracts signed by its Chile office. This year so far has also proven rather challenging for dry bulk markets, necessitating fresh financial support before the expected market recovery in the second half of 2019 in which the firm will “utilize the current market volatility” to its advantage, Ismar says.

Intended to provide so-called alternative financing for new shipping projects, General Credit Corp has been in development by Peter Georgiopoulos. The shipping magnate is reportedly working with at least two other executives in the publicly-listed shipping sphere, believed to be ex-Gener8 CFO Leo Vrondissis and ex-Gener8 VP of Finance George Fikaris. The fund is being developed in the growing realm of alternative finance, lending to shipowners (at higher margins) who can’t access funding from traditional ship lenders. Traditional maritime funding has become increasingly tight after the financial crisis and the collapse of generous shipping credit pre-2008. It remains unclear when the fund will be launched.

German bank NordLB, which recently announced its intention to completely withdraw from shipping, reported this week that it had sold off one portfolio of non-performing loans (NPLs) in shipping (nicknamed “Big Ben”) for a total of EUR 2.6 billion to US hedge fund Cerberus Capital Management. The portfolio, holding loans for 263 vessels, is categorized as 90% non-performing and will lower the bank’s total NPL shipping loans to EUR 4.9 billion from a previous level of EUR 7.5 billion at the end of last year.

For more of BMTI’s daily shipping analysis, subscribe to the BMTI DAILY REPORT today.

Again averting disaster at the last minute, Capesize freights pull back from oblivion to post even better upgrades than the start of the week, thanks to a return in chartering interest, moving trans-Atlantic RV rates well into the US$ 5,000s and front hauls to within range of US$ 19,000 daily. Actual time charter fixtures are still forthcoming, one hopes, but the fact that freight improvements are building steam rather than losing it suggests that this undervalued market is overdue some upward corrections. Pacific RVs hover in the US$ 4,000s, so they would have a ways to go to regain profitability, but given current trends, that remains plausible before month’s end. Now the Panamaxes find themselves a bit worse for wear than they were just a week ago with daily losses starting to pick up heft and charterers developing an allergy to getting involved in a market that seems to be swinging back into their favour. Activity has been sparse this week thus far and Atlantic business has slowed to a trickle on ECSA delivery with only a handful of rounds from the Pacific and back fetching around US$ 11,000 daily DOP on modern tonnage. Hanging on for dear life, Supramax owners are resisting a downturn in sentiment that is appearing to be increasingly inevitable as cargoes stay stubbornly slow. Period chartering is seen in stops and starts with short period deals on Tess 58s having done US$ 11,500 on Far East delivery with worldwide redel. NoPac RVs manage to stay in the high US$ 7,000s, but limited interest on Singapore-Japan redel could spell a sharper downturn as the week goes on. Black Sea front hauls are flat in the US$ 12,000s.

The world’s second-largest non-Chinese aluminium producer, Rusal, began new production operations last week at its Boguchansk aluminium smelter in Siberia. This added output essentially doubles the plant’s capacity to 298,000mt tonnes; the company is even considering adding more capacity, already, according to CEO Evgenii Nikitin. Rusal has been busy resuming output and shipments since the end of last year when sanctions imposed by the United States were lifted after nine months of negotiations that ended in founder Oleg Deripaska giving up his control of the company. While the company lost contracts in the sanctions period, it says it is busy winning supply contracts back for 2020 and expects to “restore lost positions” in its traditional markets, particularly in Asia and America. Shipments in Europe seem to have been less disturbed, but the new output activity and lifting of sanctions are likely to see increased aluminium shipments along European waterways as well. Rusal is also busy building a new smelter in Taishet set to launch late next year. The company expects worldwide aluminium demand to grow 3.7% this year to 68 Mt and keep growing at the same rate in 2020.

Rate recovery is still elusive for the nonperforming Capesize sector. A severe lack of demand having its way with spot freights. All things considered, they could be plummeting more sharply than they are given the wide range of tonnage currently available to charterers. But it would seem that more owners are just refusing to go any farther below breakeven, which has long since been passed. In fact, it’s hard to imagine a Capesize owner having secured any profit so far this year, such is the miserable base level for earnings at the moment. Pacific-based voyages have nonetheless stabilized for the most part with Brazil/China voyages holding firm in the range of US$ 11.6-11.7/mt. That kind of stability counts for something, and shouldn’t be underestimated, owners are advised to remind themselves. Everything is coming up Panamaxes, one could say, with only a shiver of trouble appearing in the eastern basin as Pacific round voyages seem to have peaked at US$ 8,000 daily. Indeed, most new RVs for next week are said to be trading in the high US$ 7,000s. This uggests that owners may once again find themselves struggling to keep rates in place. Atlantic Panamax owners, on the other hand, remain well-placed for the ongoing South American surge as tighter avails mean TARVs can move into the middle US$ 8,000s. Trouble in paradise for the eastern Supramaxes as charterers put on the brakes before the weekend. Rate gains have come to a halt in the eastern basin. Pacific RVs are still hovering at around US$ 9,000 for 58,000 dwt tonnage, but we do hear that charterers have been moving their ideas downward for early April positions. Western trends remain on the bullish side, at any rate, as USG delivery is still giving owners good reason to pursue higher-than-last rate levels. Front hauls ex-USG are still rising, albeit more slowly, with US$ 19,000s reported by some for CJK redel even as US$ 18,000s are the new standard area for eastbound Ultramaxes.

For more of BMTI’s daily shipping analysis, subscribe to the BMTI DAILY REPORT today.

Off like a light, the Capesize rebound of last week seems to have hit a wall at the start of this week with a very strong reversal of negative US$ 800-900 (or thereabouts) on the trans-Pacific RV taking those rates back into the low US$ 7,000s daily range. Few new fixtures have emerged so far this week, though that could still change by midweek, owners say. On the other hand, if the activity that helped buoy the spot markets last week doesn’t reappear quickly, there is a very good possibility that new downward corrections will start coming fast and furious. Voyage rates have remained stable so far with Brazil/ China unchanged in the area of US$ 11.9-12.0/mt. There does seem to be plenty of energy left in the Panamax markets with the positive momentum of last week pushing into this week and keeping trends bullish. TARVs look to be the most improved even as US$ 5-6,000s rates are still poor for any owners hoping to make a profit in this challenging market. Slightly more promising are front hauls, which are benefitting from a modest renaissance from South America as DOP rates ex-Brazil (open UKC-Med) are granting Kamsarmax ships upwards of US$ 16,000. Apart from the collapsing Black Sea front hauls (in a replay of the same on USG front hauls two weeks ago), Handy bulk rates remain rather steady in the Atlantic and even bullish on South America delivery. ECSA export trips are currently keeping the entire western market aloft, it would seem, with front hauls getting upwards of US$ 13,000 daily DOP to the Far East on tonnage of 58,000 dwt and even US$ 14,000 daily on Ultramax vessels exceeding 62,000 dwt. The USG/UKC trans-Atlantic trips are holding steady in the US$ 10-11,000 range on Tess 58s.

For more of BMTI’s daily shipping analysis, subscribe to the BMTI DAILY REPORT today.

Scorpio Bulkers [SALT] sold seven ships to China Merchant Bank Financial Leasing in a sale-and-leaseback deal wherein the owner will lease the ships back from the partially state-owned bank. Scorpio says it will add US$ 60m in liquidity from the deal.

The New York-listed dry bulk company, Eagle Bulk [EGLE], was pleased to announce in its new annual report to having secured a profit in 2018, offsetting a deficit in the year before. Last year saw revenue rise by 31% thanks to gains in the dry bulk market as a whole and a rise in available ship days for its vessels (the company purchased 12 Ultramax carriers in the last two years). Company CEO Gary Vogel says Eagle Bulk plans to continue executing its fleet renewal plan. A refinancing plan in 2018 also gave the company some US$ 65m in new liquidity, which helped it lower debt costs and extended maturation dates for existing loans. Revenue grew US$ 73.3m to US$ 310.1m in 2018, contributing to a new profit of US$ 12.6m in the year versus a deficit of US$ 43.8m the year before. For the first quarter of 2019, the company has already secured 90% of its ship days for its fleet at an average TCE of US$ 9,124 daily. Ahead of the 2020 sulphur regulations, Eagle Bulk says it will already have 37 of its ships fitted with scrubbers. The company fleet currently consists of 47 dry bulk carriers made up of Supramax and Ultramax ships.

Investment opportunities have thinned out for the bulk carriers in the year so far with freight rates under pressure, but near term prospects are still well-balanced between cargo and tonnage, according to Court Smith of VesselsValue at the recent German Ship Finance Forum in Hamburg. There is, however, a negative mismatch between expected tonne-mile growth and tonnage growth for nearly every bulker size, with the exception of one, Smith said. In terms of tonne-mile growth vs. supply growth in 2019, Smith expected to see -0.9% for Capesizes, -0.7% for Panamaxes, -0.9% for Supramaxes but + 0.4% for Handysize vessels. Given the overall “positive balance” in the Handysize sector, Smith recommends the smallest bulker size class as the best “top level” investment perspective for the current market.

For more of BMTI’s daily shipping analysis, subscribe to the BMTI DAILY REPORT today.

Charterer interest in Panamaxes fades

Enquiry for Panamaxes has apparently dried up in the way that Cape interest dried up in late February. (p. 1)

Long haul business stays active on Ultramaxes

From WCCA, Ultramax tonnage was shown US$ 8,000 for a trip to the Med-Continent area. (p. 2)

Containership rates continue steady decline

The modest but steady downward trend in container freights remained well in place last week with an average of 4-5% lost on freights (down 4.6% on the SCFI), showing not a single positive progression in any single rate, unlike weeks past. (p. 2)

For more of BMTI’s daily shipping analysis, subscribe to the BMTI DAILY REPORT today.

An upsurge in activity across the eastern basin has done wonders for the long-beleaguered Supramax markets with average rates for rounds up by at least US$ 500 week-on-week and, in some cases, nearly US$ 1,000 higher than a week ago. Standard rounds are trading in the US$ 6-7,000s daily on tonnage of 58,000 dwt. Indonesia rounds have been especially improved with a massive US$ 2,000 week-on-week improvement in average rates from South China to ECI, climbing into the US$ 6,000s by week’s end. Handysize markets have been comparatively more subdued than their high-flying Supramax brethren, although eastern trends have been favourable to the smaller sized segment as well. Pacific rounds via Singapore-Japan from CJK edged up into the US$ 4,000s after spending the past week in the high US$ 3,000s. Southeast Asia has been especially buoyant with tonnage of 28,000 dwt getting over US$ 6,000 daily with sugar from Thailand to Indonesia (though standard cargoes are more likely to fetch US$ 5,000s on this run). Tonnage of 38,000 dwt is securing high US$ 5,000s daily on NoPac trips to South Korea.

For more of BMTI’s daily shipping analysis, subscribe to the BMTI DAILY REPORT today.

Slowly, it would seem that the Capesize freights are stabilizing, with the possible exception of long hauls on TARV and front haul terms, with voyages nearly all trending flat or slightly higher. Aussie voyages appear to be the most buoyant at the moment with upwards of US$ 5.3/mt being reportedly negotiated on tonnage of 170,000mt from West Australia to South China. This is around US$ 0.3-0.5/mt higher than the rate was trading at this time last week. There has been some considerable slowing in coking coal traffic from Australia to China, traders report, with customs delays causing vessels to have waiting times of up to 60 days to unload at Chinese ports. This, combined with recently disrupted operations at two coal mines in Australia, is expected to put a brake on Australian coal exports for the near term.

Freights continue to fall rather precipitously in the Azov trades with owners continuously coming up short on the cargo side of the market. Owners say rates have fallen so quickly since their recent peak at the end of 2018 that they are down as much as US$ 9/mt now from that point, roughly a third, considering that Azov/Marmara rates are currently in the low US$ 20s/mt on grain of 5,000mt (46′). A veritable perfect storm of bearish conditions—extended port delays at Russian ports, the stronger rouble, increased domestic commodity demand (along with lower international demand), rising domestic prices and the fairly mild winter—are conspiring to make this winter a tougher than usual one for shipowners. Kherson/TBS has stabilized at US$ 20-22/mt.

Freights continue to fall rather precipitously in the Azov trades with owners continuously coming up short on the cargo side of the market. Owners say rates have fallen so quickly since their recent peak at the end of 2018 that they are down as much as US$ 9/mt now from that point, roughly a third, considering that Azov/Marmara rates are currently in the low US$ 20s/mt on grain of 5,000mt (46′). A veritable perfect storm of bearish conditions—extended port delays at Russian ports, the stronger rouble, increased domestic commodity demand (along with lower international demand), rising domestic prices and the fairly mild winter—are conspiring to make this winter a tougher than usual one for shipowners. Kherson/TBS has stabilized at US$ 20-22/mt.

Need more short sea news? Consider a subscription to the BMTI SHORT SEA REPORT.

Apart from a few late-reported fixtures that emerged at the end of the week, little if any guidance is visible for the sliding freight market for Capesizes. Front haul trips have assumed the mantle of most bearish route at the moment with losses of some US$ 1,000 between Thursday and Friday taking the assessment under US$ 27,000 daily. It is difficult to measure rate levels with so few fixtures available, but suffice it to say that charterers are having a good 2019 so far.

The periodic return of Panamax activity, assisted by more Continental demand than in weeks past, still fails to shift the freight trend from its downward path. Shipowners are hoping against hope that the market’s overhang of available tonnage will finally be arrested, but as long as cargo demand can be held back, there is little likelihood of the same in the near term. Period chartering remains one highlight with upwards of US$ 10,750 daily rumoured as fixed for 5-8 months on a Kamsarmax with worldwide redel.

Atlantic delivery remains fraught for Handy bulk owners, though talk of high US$ 13,000s fixed from the Baltic to AG on Supramaxes has been encouraging for owners. Most new activity remains isolated within the eastern basin where Pacific round voyages have stabilized in the US$ 7,000s daily area, leaving most of the losses to the West. Indonesia rounds on Vietnam redelivery are said to have fixed APS terms at about US$ 7,000 daily on tonnage of 58,000 dwt.

For more of BMTI’s daily shipping analysis, subscribe to the BMTI DAILY REPORT today.

The last few weeks of 2018 were among the best of the entire year itself for northern European short sea owners as a long-delayed recovery in freight levels finally transpired and put owners in the position of power that they had been denied for most of the preceding eleven months. Trading volumes fell significantly over the holidays with nearly all market participants away from their desks and momentum taking freights over the transom of the no man’s land between years. With real trading resuming in earnest this week, the first full business week of the year, owners are hoping that any pressure that developed over the holidays will again be relieved as market fundamentals take over once again. Colder weather conditions will surely play a part with wind and ice-related delays slowing turnaround times and shortening general availabilities. At any rate, southbound traffic from WCUK into the Italian Adriatic has been holding steady with freights still in the low EUR 30s/mt on general parcels of 3-5,000mt. Northbound rates from the West Med to ARAG are fetching upwards of EUR 19/mt, but more likely to be in the EUR 17-18/mt unless charterers express some degree of urgency. There is a tangible sense of renewed optimism among owners in the North Sea and Baltic Sea trades that momentum will remain on their side, at least in these early days, though they are still in desperate need of evidence of the same before it starts to look like premature hope. The westward trades from the upper Baltic into the ARAG area are fixing low EUR 20s/mt of up to EUR 21-22/mt, which is quite an improvement on the mid-high teens of EUR 16-18/mt observed just a few weeks before. Rates from the German Baltic to Ireland have been recorded up to EUR 28.5/mt on generals of 3,000mt, but at least one broker claims the average rate on this business is more likely in the area of EUR 26.5-27.5/mt. All things being equal and based on the persistently stagnant fleet growth of the European market, any uptick in demand will most likely be immediately felt in rate levels. Owners are praying that such an uptick arrives as soon as possible.