Capesize freights rose by as much as 38% last week, according to some metrics, with the recover in sentiment buoyed by the reopening of Vale’s Brucutu iron ore mine in Brazil and very strong voyage activity in the Pacific. With over 80% of bulk carrier trade said to be linked to iron ore (also, according to some metrics), the oversized influence of this commodity on the bulker trades can scarcely be underestimated. Rates have continued to climb as business resumed this week after the weekend, usually a sign of a bullish market, with TARV rates moving into the US$ 9,000s and Pacific round voyages climbing into the low teens of US$ 10-11,000 daily. Front hauls have already been fixing low US$ 20,000s of up to US$ 22,000 daily, according to some brokers’ reports, with shipowners having regained the control in negotiations for the first time in many weeks. These higher levels are nonetheless precarious, traders warn, as sentiment-driven as the Cape market is, another snap in geopolitical events could send rates tumbling as fast as they climbed in the final week of April. Owners hope that market fundamentals will solidify (as open tonnage tightens up) to keep this from happening.

After Easter break, one can’t but conclude that still not much is going on. The market in general remains pretty disappointing without any immediate ray of hope. Even though some brokers report a flurry of activity, others keep talking of a market trudging along. Indeed, the numbers talked and reported indeed suggest the latter. Off the Continent, Ultramaxes are being fixed in the low US$ 8,000s for a short local employment. The owners of a 56,000 dwt vessel have been seeing US$ 9,000 daily from scrap charterers for a trip to the East Med. Handy rates have been equally disenchanting with a 38,000 dwt booked for a Baltic round voyage with delivery Rotterdam at a rate of US$ 6,500 daily. The Black Sea remains a “graveyard” for the owners. Ultra-Supramax owners prefer to ballast away instead of taking front hauls of US$ 11-12,000 daily.

Adriatic Sea market: Traffic has been sporadic at best. Ammonium nitrate of 1,000mt has secured US$ 39-40/mt from Alexandria to Sarande (Albania). Steels of 1-2,000mt have fixed high US$ 30s/mt of up to US$ 37-38/mt ex-Nemrut to Split, brokers say. Standard grains of 5,000mt (46′) are being done from Yeisk into the Italian Adriatic at US$ 35/mt.

Turkish Med: As usual, import shipments to the Turkish Med have been considerable and trade has been steady in Q2 thus far. Fertilizers (urea) of 5-6,000mt have been routinely securing upwards of US$ 15/mt into Antalya from Damietta (and elsewhere in Egypt). Grains of 5,000mt (46′) ex-Novorossiysk to Mersin are being fixed at US$ 23-24/mt. Steels (2,000mt) from Iskenderun to Constanta have been reportedly concluded at about US$ 26-27/mt.

Operator Western Bulk Chartering announced that it has secured new debt financing and intends to raise US$ 15m in equity, ensured by its two main shareholders, in order to “support further growth” and strengthen its financial platform, said CEO Jens Ismar. The bond of US$ 35.1m (and US$ 31.74 outstanding) will be repaid in full, according to a statement from the company. WBC made an after-tax profit of US$ 4.2m last year, but suffered a big write-off in the second half of the year (US$ 10m) due to ill-timed time charter contracts signed by its Chile office. This year so far has also proven rather challenging for dry bulk markets, necessitating fresh financial support before the expected market recovery in the second half of 2019 in which the firm will “utilize the current market volatility” to its advantage, Ismar says.

Intended to provide so-called alternative financing for new shipping projects, General Credit Corp has been in development by Peter Georgiopoulos. The shipping magnate is reportedly working with at least two other executives in the publicly-listed shipping sphere, believed to be ex-Gener8 CFO Leo Vrondissis and ex-Gener8 VP of Finance George Fikaris. The fund is being developed in the growing realm of alternative finance, lending to shipowners (at higher margins) who can’t access funding from traditional ship lenders. Traditional maritime funding has become increasingly tight after the financial crisis and the collapse of generous shipping credit pre-2008. It remains unclear when the fund will be launched.

German bank NordLB, which recently announced its intention to completely withdraw from shipping, reported this week that it had sold off one portfolio of non-performing loans (NPLs) in shipping (nicknamed “Big Ben”) for a total of EUR 2.6 billion to US hedge fund Cerberus Capital Management. The portfolio, holding loans for 263 vessels, is categorized as 90% non-performing and will lower the bank’s total NPL shipping loans to EUR 4.9 billion from a previous level of EUR 7.5 billion at the end of last year.

For more of BMTI’s daily shipping analysis, subscribe to the BMTI DAILY REPORT today.

Again averting disaster at the last minute, Capesize freights pull back from oblivion to post even better upgrades than the start of the week, thanks to a return in chartering interest, moving trans-Atlantic RV rates well into the US$ 5,000s and front hauls to within range of US$ 19,000 daily. Actual time charter fixtures are still forthcoming, one hopes, but the fact that freight improvements are building steam rather than losing it suggests that this undervalued market is overdue some upward corrections. Pacific RVs hover in the US$ 4,000s, so they would have a ways to go to regain profitability, but given current trends, that remains plausible before month’s end. Now the Panamaxes find themselves a bit worse for wear than they were just a week ago with daily losses starting to pick up heft and charterers developing an allergy to getting involved in a market that seems to be swinging back into their favour. Activity has been sparse this week thus far and Atlantic business has slowed to a trickle on ECSA delivery with only a handful of rounds from the Pacific and back fetching around US$ 11,000 daily DOP on modern tonnage. Hanging on for dear life, Supramax owners are resisting a downturn in sentiment that is appearing to be increasingly inevitable as cargoes stay stubbornly slow. Period chartering is seen in stops and starts with short period deals on Tess 58s having done US$ 11,500 on Far East delivery with worldwide redel. NoPac RVs manage to stay in the high US$ 7,000s, but limited interest on Singapore-Japan redel could spell a sharper downturn as the week goes on. Black Sea front hauls are flat in the US$ 12,000s.

The world’s second-largest non-Chinese aluminium producer, Rusal, began new production operations last week at its Boguchansk aluminium smelter in Siberia. This added output essentially doubles the plant’s capacity to 298,000mt tonnes; the company is even considering adding more capacity, already, according to CEO Evgenii Nikitin. Rusal has been busy resuming output and shipments since the end of last year when sanctions imposed by the United States were lifted after nine months of negotiations that ended in founder Oleg Deripaska giving up his control of the company. While the company lost contracts in the sanctions period, it says it is busy winning supply contracts back for 2020 and expects to “restore lost positions” in its traditional markets, particularly in Asia and America. Shipments in Europe seem to have been less disturbed, but the new output activity and lifting of sanctions are likely to see increased aluminium shipments along European waterways as well. Rusal is also busy building a new smelter in Taishet set to launch late next year. The company expects worldwide aluminium demand to grow 3.7% this year to 68 Mt and keep growing at the same rate in 2020.

Rate recovery is still elusive for the nonperforming Capesize sector. A severe lack of demand having its way with spot freights. All things considered, they could be plummeting more sharply than they are given the wide range of tonnage currently available to charterers. But it would seem that more owners are just refusing to go any farther below breakeven, which has long since been passed. In fact, it’s hard to imagine a Capesize owner having secured any profit so far this year, such is the miserable base level for earnings at the moment. Pacific-based voyages have nonetheless stabilized for the most part with Brazil/China voyages holding firm in the range of US$ 11.6-11.7/mt. That kind of stability counts for something, and shouldn’t be underestimated, owners are advised to remind themselves. Everything is coming up Panamaxes, one could say, with only a shiver of trouble appearing in the eastern basin as Pacific round voyages seem to have peaked at US$ 8,000 daily. Indeed, most new RVs for next week are said to be trading in the high US$ 7,000s. This uggests that owners may once again find themselves struggling to keep rates in place. Atlantic Panamax owners, on the other hand, remain well-placed for the ongoing South American surge as tighter avails mean TARVs can move into the middle US$ 8,000s. Trouble in paradise for the eastern Supramaxes as charterers put on the brakes before the weekend. Rate gains have come to a halt in the eastern basin. Pacific RVs are still hovering at around US$ 9,000 for 58,000 dwt tonnage, but we do hear that charterers have been moving their ideas downward for early April positions. Western trends remain on the bullish side, at any rate, as USG delivery is still giving owners good reason to pursue higher-than-last rate levels. Front hauls ex-USG are still rising, albeit more slowly, with US$ 19,000s reported by some for CJK redel even as US$ 18,000s are the new standard area for eastbound Ultramaxes.

For more of BMTI’s daily shipping analysis, subscribe to the BMTI DAILY REPORT today.

Off like a light, the Capesize rebound of last week seems to have hit a wall at the start of this week with a very strong reversal of negative US$ 800-900 (or thereabouts) on the trans-Pacific RV taking those rates back into the low US$ 7,000s daily range. Few new fixtures have emerged so far this week, though that could still change by midweek, owners say. On the other hand, if the activity that helped buoy the spot markets last week doesn’t reappear quickly, there is a very good possibility that new downward corrections will start coming fast and furious. Voyage rates have remained stable so far with Brazil/ China unchanged in the area of US$ 11.9-12.0/mt. There does seem to be plenty of energy left in the Panamax markets with the positive momentum of last week pushing into this week and keeping trends bullish. TARVs look to be the most improved even as US$ 5-6,000s rates are still poor for any owners hoping to make a profit in this challenging market. Slightly more promising are front hauls, which are benefitting from a modest renaissance from South America as DOP rates ex-Brazil (open UKC-Med) are granting Kamsarmax ships upwards of US$ 16,000. Apart from the collapsing Black Sea front hauls (in a replay of the same on USG front hauls two weeks ago), Handy bulk rates remain rather steady in the Atlantic and even bullish on South America delivery. ECSA export trips are currently keeping the entire western market aloft, it would seem, with front hauls getting upwards of US$ 13,000 daily DOP to the Far East on tonnage of 58,000 dwt and even US$ 14,000 daily on Ultramax vessels exceeding 62,000 dwt. The USG/UKC trans-Atlantic trips are holding steady in the US$ 10-11,000 range on Tess 58s.

For more of BMTI’s daily shipping analysis, subscribe to the BMTI DAILY REPORT today.

Scorpio Bulkers [SALT] sold seven ships to China Merchant Bank Financial Leasing in a sale-and-leaseback deal wherein the owner will lease the ships back from the partially state-owned bank. Scorpio says it will add US$ 60m in liquidity from the deal.

The New York-listed dry bulk company, Eagle Bulk [EGLE], was pleased to announce in its new annual report to having secured a profit in 2018, offsetting a deficit in the year before. Last year saw revenue rise by 31% thanks to gains in the dry bulk market as a whole and a rise in available ship days for its vessels (the company purchased 12 Ultramax carriers in the last two years). Company CEO Gary Vogel says Eagle Bulk plans to continue executing its fleet renewal plan. A refinancing plan in 2018 also gave the company some US$ 65m in new liquidity, which helped it lower debt costs and extended maturation dates for existing loans. Revenue grew US$ 73.3m to US$ 310.1m in 2018, contributing to a new profit of US$ 12.6m in the year versus a deficit of US$ 43.8m the year before. For the first quarter of 2019, the company has already secured 90% of its ship days for its fleet at an average TCE of US$ 9,124 daily. Ahead of the 2020 sulphur regulations, Eagle Bulk says it will already have 37 of its ships fitted with scrubbers. The company fleet currently consists of 47 dry bulk carriers made up of Supramax and Ultramax ships.

Investment opportunities have thinned out for the bulk carriers in the year so far with freight rates under pressure, but near term prospects are still well-balanced between cargo and tonnage, according to Court Smith of VesselsValue at the recent German Ship Finance Forum in Hamburg. There is, however, a negative mismatch between expected tonne-mile growth and tonnage growth for nearly every bulker size, with the exception of one, Smith said. In terms of tonne-mile growth vs. supply growth in 2019, Smith expected to see -0.9% for Capesizes, -0.7% for Panamaxes, -0.9% for Supramaxes but + 0.4% for Handysize vessels. Given the overall “positive balance” in the Handysize sector, Smith recommends the smallest bulker size class as the best “top level” investment perspective for the current market.

For more of BMTI’s daily shipping analysis, subscribe to the BMTI DAILY REPORT today.

Charterer interest in Panamaxes fades

Enquiry for Panamaxes has apparently dried up in the way that Cape interest dried up in late February. (p. 1)

Long haul business stays active on Ultramaxes

From WCCA, Ultramax tonnage was shown US$ 8,000 for a trip to the Med-Continent area. (p. 2)

Containership rates continue steady decline

The modest but steady downward trend in container freights remained well in place last week with an average of 4-5% lost on freights (down 4.6% on the SCFI), showing not a single positive progression in any single rate, unlike weeks past. (p. 2)

For more of BMTI’s daily shipping analysis, subscribe to the BMTI DAILY REPORT today.

An upsurge in activity across the eastern basin has done wonders for the long-beleaguered Supramax markets with average rates for rounds up by at least US$ 500 week-on-week and, in some cases, nearly US$ 1,000 higher than a week ago. Standard rounds are trading in the US$ 6-7,000s daily on tonnage of 58,000 dwt. Indonesia rounds have been especially improved with a massive US$ 2,000 week-on-week improvement in average rates from South China to ECI, climbing into the US$ 6,000s by week’s end. Handysize markets have been comparatively more subdued than their high-flying Supramax brethren, although eastern trends have been favourable to the smaller sized segment as well. Pacific rounds via Singapore-Japan from CJK edged up into the US$ 4,000s after spending the past week in the high US$ 3,000s. Southeast Asia has been especially buoyant with tonnage of 28,000 dwt getting over US$ 6,000 daily with sugar from Thailand to Indonesia (though standard cargoes are more likely to fetch US$ 5,000s on this run). Tonnage of 38,000 dwt is securing high US$ 5,000s daily on NoPac trips to South Korea.

For more of BMTI’s daily shipping analysis, subscribe to the BMTI DAILY REPORT today.

Slowly, it would seem that the Capesize freights are stabilizing, with the possible exception of long hauls on TARV and front haul terms, with voyages nearly all trending flat or slightly higher. Aussie voyages appear to be the most buoyant at the moment with upwards of US$ 5.3/mt being reportedly negotiated on tonnage of 170,000mt from West Australia to South China. This is around US$ 0.3-0.5/mt higher than the rate was trading at this time last week. There has been some considerable slowing in coking coal traffic from Australia to China, traders report, with customs delays causing vessels to have waiting times of up to 60 days to unload at Chinese ports. This, combined with recently disrupted operations at two coal mines in Australia, is expected to put a brake on Australian coal exports for the near term.

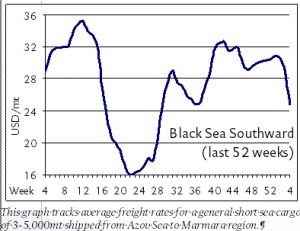

Freights continue to fall rather precipitously in the Azov trades with owners continuously coming up short on the cargo side of the market. Owners say rates have fallen so quickly since their recent peak at the end of 2018 that they are down as much as US$ 9/mt now from that point, roughly a third, considering that Azov/Marmara rates are currently in the low US$ 20s/mt on grain of 5,000mt (46′). A veritable perfect storm of bearish conditions—extended port delays at Russian ports, the stronger rouble, increased domestic commodity demand (along with lower international demand), rising domestic prices and the fairly mild winter—are conspiring to make this winter a tougher than usual one for shipowners. Kherson/TBS has stabilized at US$ 20-22/mt.

Freights continue to fall rather precipitously in the Azov trades with owners continuously coming up short on the cargo side of the market. Owners say rates have fallen so quickly since their recent peak at the end of 2018 that they are down as much as US$ 9/mt now from that point, roughly a third, considering that Azov/Marmara rates are currently in the low US$ 20s/mt on grain of 5,000mt (46′). A veritable perfect storm of bearish conditions—extended port delays at Russian ports, the stronger rouble, increased domestic commodity demand (along with lower international demand), rising domestic prices and the fairly mild winter—are conspiring to make this winter a tougher than usual one for shipowners. Kherson/TBS has stabilized at US$ 20-22/mt.

Need more short sea news? Consider a subscription to the BMTI SHORT SEA REPORT.

Apart from a few late-reported fixtures that emerged at the end of the week, little if any guidance is visible for the sliding freight market for Capesizes. Front haul trips have assumed the mantle of most bearish route at the moment with losses of some US$ 1,000 between Thursday and Friday taking the assessment under US$ 27,000 daily. It is difficult to measure rate levels with so few fixtures available, but suffice it to say that charterers are having a good 2019 so far.

The periodic return of Panamax activity, assisted by more Continental demand than in weeks past, still fails to shift the freight trend from its downward path. Shipowners are hoping against hope that the market’s overhang of available tonnage will finally be arrested, but as long as cargo demand can be held back, there is little likelihood of the same in the near term. Period chartering remains one highlight with upwards of US$ 10,750 daily rumoured as fixed for 5-8 months on a Kamsarmax with worldwide redel.

Atlantic delivery remains fraught for Handy bulk owners, though talk of high US$ 13,000s fixed from the Baltic to AG on Supramaxes has been encouraging for owners. Most new activity remains isolated within the eastern basin where Pacific round voyages have stabilized in the US$ 7,000s daily area, leaving most of the losses to the West. Indonesia rounds on Vietnam redelivery are said to have fixed APS terms at about US$ 7,000 daily on tonnage of 58,000 dwt.

For more of BMTI’s daily shipping analysis, subscribe to the BMTI DAILY REPORT today.

The last few weeks of 2018 were among the best of the entire year itself for northern European short sea owners as a long-delayed recovery in freight levels finally transpired and put owners in the position of power that they had been denied for most of the preceding eleven months. Trading volumes fell significantly over the holidays with nearly all market participants away from their desks and momentum taking freights over the transom of the no man’s land between years. With real trading resuming in earnest this week, the first full business week of the year, owners are hoping that any pressure that developed over the holidays will again be relieved as market fundamentals take over once again. Colder weather conditions will surely play a part with wind and ice-related delays slowing turnaround times and shortening general availabilities. At any rate, southbound traffic from WCUK into the Italian Adriatic has been holding steady with freights still in the low EUR 30s/mt on general parcels of 3-5,000mt. Northbound rates from the West Med to ARAG are fetching upwards of EUR 19/mt, but more likely to be in the EUR 17-18/mt unless charterers express some degree of urgency. There is a tangible sense of renewed optimism among owners in the North Sea and Baltic Sea trades that momentum will remain on their side, at least in these early days, though they are still in desperate need of evidence of the same before it starts to look like premature hope. The westward trades from the upper Baltic into the ARAG area are fixing low EUR 20s/mt of up to EUR 21-22/mt, which is quite an improvement on the mid-high teens of EUR 16-18/mt observed just a few weeks before. Rates from the German Baltic to Ireland have been recorded up to EUR 28.5/mt on generals of 3,000mt, but at least one broker claims the average rate on this business is more likely in the area of EUR 26.5-27.5/mt. All things being equal and based on the persistently stagnant fleet growth of the European market, any uptick in demand will most likely be immediately felt in rate levels. Owners are praying that such an uptick arrives as soon as possible.

Some of the shine is already off of the Capesizes as the week comes to an end with the reality setting in that charterers are far from anxious to fix any major business this early in the year. As such, corrections come nearly immediately on the high-flying Pacific RVs, neutralizing the gains they made yesterday by an equal US$ 400-500 to bring them back to US$ 14,000. The rest of the market is moving more or less sideways, awaiting the first full business week.

Some of the shine is already off of the Capesizes as the week comes to an end with the reality setting in that charterers are far from anxious to fix any major business this early in the year. As such, corrections come nearly immediately on the high-flying Pacific RVs, neutralizing the gains they made yesterday by an equal US$ 400-500 to bring them back to US$ 14,000. The rest of the market is moving more or less sideways, awaiting the first full business week.

Encouragingly active at the tail end of the week than at the beginning, Panamax fixing has still failed to turn trends around from their bearish paths. Period business has been especially prominent in the first week of the year with several short period deals (3-5 to 4-6 and 4-8 months) being concluded in the US$ 11,000s on standard tonnage and up to US$ 13,500 daily and higher on modern Kamsarmax tonnage of 82,000 dwt. The spot markets are nonetheless tepid.

If fixtures were any indication, one would think the Handy bulk is on the rebound. And that may still be the case in another day or two, but so far they increase in chartering activity has failed to make a dent in the resolutely downward trend of USG Supramax rates, which have fallen to US$ 26,000 daily on the benchmark for front hauls to CJK. Eastern activity has helped keep rates in the eastern hemisphere far more stable, all things considered, with mineral demand via Southeast Asia already taking a lead role.

For more of BMTI’s daily shipping analysis, subscribe to the BMTI DAILY REPORT today.

Panamaxes cheaper than Ultramaxes on trips from ECSA

The ECSA has been steady with Ultramaxes fixed at US$ 15,250 daily plus US$ 525,000 BB whilst Panamaxes have been cheaper; hence chars are trying to change to Panamaxes whenever possible. (p. 1)

Eastern Handysize rates stay in the doldrums

Owners of 32,000 dwt tonnage were talking middle US$ 5,000 daily for a trip from China to USWC. (p. 1)

Scrap prices correcting as Turkish mills buy less

Spot market prices for scrap metal in Europe took a sharp fall last week in sync with falling steel prices and cooling demand to Turkish steel mills. (p. 2)

For more of BMTI’s daily shipping analysis, subscribe to the BMTI DAILY REPORT today.

Hong Kong bulk carrier firm, Pacific Basin, has concluded a US$ 40m loan facility with Danish Ship Finance, it announced last week. The facility, intended for seven years duration, is an extension of the company’s existing loan agreement with DSF and will be secured by the same 19 ships under the initial facility. Pacific Basin says that the new facility was achieved at a competitive interest rate and will go to improve the company’s financial flexibility.

Scorpio Bulkers and Tankers have upgraded their plans for extensive installation of scrubbers across their fleets with the stated intention of “practically all” of its owned and chartered Kamsarmax and Ultramax ships. Scorpio Bulkers fleet amounts to 56 owned and chartered vessels of which 19 are Kamsarmaxes and 37 are Ultramaxes. With initial plans for open-loop scrubbers, eventually to be upgraded up to closed-loop units, overall investment will add up to US$ 42.4m for Scorpio Bulkers (28 vessels) and US$ 79.6m for Scorpio Tankers (52 vessels).

Having found shipping as one of the last frontiers of digitalisation, Hamburg-based TecPier has launched as an investment organisation to discover start-ups to support with funding, operational resources and networking with established industrial partners in the maritime sector. The company plans to invest mainly in start-ups in the pre-seed and seed phases to guide young companies in their early development phase. TecPier has formed partnerships with Zeaborn Group, BitStone Capital and Inno Real with shareholders in VC and shipping. Founding partner, Johannes Winkler, says TecPier has found over 150 start-ups with real potential for investment and development in the arena of shipping digitalisation.

Secondhand bulkers remain very undervalued, says Martin Rowe, head of Clarksons Platou, given their earnings potential. The current price for a ten-year-old Capesize, said Rowe at a maritime conference in Hong Kong, is some 30-50% of what it should be.

For more of BMTI’s daily shipping analysis, subscribe to the BMTI DAILY REPORT today.

They had a good run, but looking at the declines that have hit the Capesizes at the end of the week, it would seem like classic over-correction being swiftly neutralized following a false dawn of spot market recovery. No route is spared with Pacific round voyages—appropriately, considering their oversized improvements—taking the worst of the decline, losing more than US$ 2,000 to settle in the high teens of US$ 17-18,000. Front haul trips, meanwhile, slip into the mid US$20,000s of about US$ 25,000 daily after fading from the high US$20,000s set at midweek. Voyages have also come under heat as West Aussie rates to China slide to just above US$ 8/mt and Brazil/China voyages fall under US$ 17.5/mt.

If not quite at a boiling point, Panamaxes continue enjoying positive sentiment pushing rates higher yet with TARVs now likely to trade at US$ 14,000 daily (or just below) on early December dates, much improved from the US$ 13,000s of last week and weeks before. Pacific RVs are also holding to just over US$ 9,000 daily on standard 72-76,000 dwt tonnage with a notable upside still very much in place. Front hauls stabilized at around US$ 20,000 daily with slight improvements still more likely than slight discounts. Rumours abound with a market still in flux: period rates, while not taking the market by storm, are still fixed on a regular basis. There is one small Panamaxes (rumoured to be 62,000 dwt) fixed at US$ 19,500 for medium period ex-Veracruz on worldwide redelivery. Nickel ore runs on similar sizes (64-66,000 dwt) from South China have been secured at US$ 8,250 daily via Indonesia and back.

Period chartering seems to be returning to some degree to the Handy bulk sector with US$ 8-9,000 rates being done on Tess 52 tonnage from Southeast Asia on worldwide redel (3-5 months of trading). The big story in the Atlantic remains the USG with US$ 26,000 the newest high water market set for front hauls on Tess 58 ships. In the East, inter-Pacific trips are also fetching middle-high US$ 8,000s with such rates seen on 52-56,000 dwt ships from NoPac booked for trips south to Vietnam or Thailand.

To see more of BMTI’s daily dry bulk analysis, subscribe to the BMTI DAILY REPORT today.

Capesize freights start the week in limbo

Starting the week on an undecided, Capesizes trend largely sideways with only the Pacific RVs taking any considerable damage, losing only US$ 200-300 to settle in the mid US$ 8,000s. (p. 1)

Promising signs for Handies via South Africa

South African brokers expect a rush for tonnage for first half December dates, which already has inspired owners of a 56,000 dwt open ECI to indicate her for a South African RV at US$ 13,000 daily. (p. 2)

Modest uptick in box rates on USEC redelivery

More influential was the Shanghai-to-USEC route, up 3.5% week-on-week to hit US$ 3,739/FEU while the corresponding USWC redel (20% of the SCFI) fell by 1.8% to trade at US$ 2,529/FEU. (p. 2)

To see more of BMTI’s daily dry bulk analysis, subscribe to the BMTI DAILY REPORT today.

In the US Gulf, owners are grappling with weakening demand with petcoke charterers rating a 56,000 dwt at US$ 16,000 daily versus owners’ rate of US$ 18,000 daily for a trip to East Med. Even Ultramax tonnage is rated below US$ 20,000 by petcoke charterers. A 28,000 dwt has been fixed from Rio Haina for a 15-day local employment at about US$ 12,000 daily. And owners of 1984-built, 42,000 dwt vessel must consider themselves lucky to have been given the opportunity to fix her from Atlantic Columbia to North Spain at around US$ 15,500 daily. From the ECSA, front haul rates for Ultramax tonnage are hovering at around US$ 15,500 daily plus US$ 550,000 BB. The midterm future for Handysize tonnage sounds promising. With a new crop coming on stream, coastal business has already been given a boost that brokers expect to be extended to trans-Atlantic business for which rates of around US$ 18-20,000 for 36-40,000 dwt tonnage sounds realistic.

The East has not been very generous with the owners, who are aghast at the numbers that they are seeing, which has already led a couple of owners to contemplate ballasting to the Atlantic, which for eco tonnage may be an option whereby bunkers costs are more bearable than for other less eco tonnage. The owners of a 58,000 dwt ship were proposed around US$ 6,750 daily for the first 44 days to be followed with US$ 10,250 daily for the balance up to six months. Handy charterers did not hesitate to propose US$ 7,000 daily on a 38,000 dwt for a trip from P.I. to the PG, which the owners turned down asking above US$ 10,000 daily. Coal charterers were rating other similar tonnage at US$ 9,500 daily for a trip from P.I. via Indonesia to China with coal.

To benefit from BMTI’s daily shipbroker analysis, subscribe to the BMTI DAILY REPORT today.

Bearish trends continue to bite in Handy market

Gravity has started to weigh heavier on Handy bulk at midweek with declines most notable on the long hauls into the Far East with ECSA delivery to North China losing some US$ 100-300 since Monday to settle at US$ 17,000 on modern Ultramaxes. (p. 1)

Hope remains in place for Panamax owners

Panamax shipbrokers are cautiously optimistic that market conditions will remain stable, hoping for an end-of-the-year spike. (p. 1)

Enduring dryness threatens European waterways

Continuing and historically high dry conditions across Europe have seen water levels drop such that key waterways have started to reroute traffic or stop it altogether. (p. 2)

To benefit from BMTI’s daily broker analysis, subscribe to the BMTI DAILY REPORT today.

Capesize voyages enjoy solid weekly gains

New voyages on 150,000mt from South Africa to ARAG, for instance, have climbed into the range of US$ 9.7/mt, which is around US$ 2/mt higher than only a week previous. (p. 1)

Continued stability in Black Sea Handy bulk

The Black Sea remains relatively stable with grain charterers seeing US$ 24-25/mt for 30,000mt ex-Novo to Dunkirk, whilst talking US$ 23/ mt. (p. 1)

Coasters: New optimism in Baltic-based trades

Rates between the German Baltic and ARAG have edged into the area of US$ 14/mt in both directions with talk that US$ 15/mt is already in talks for late next week on upper Baltic delivery. (p. 2)

To benefit from BMTI’s daily shipbroker analysis, subscribe to the BMTI DAILY REPORT today.

A number of shipping banks issued their quarterly reports in the past week. DNB of Norway said its most recent quarterly report that it had to impair US$ 31m (NOK 261m) of loans in its shipping portfolio even as it reported a general positive turn of events in the third quarter of 2018. The bank reported that its shipping loans have seen stable development in the quarter while past impairments have been reversed. The bank has a total US$ 7.1 billion (NOK 56 billion) in loans to the shipping industry, mostly in tankers, but also in bulk, gas and containerships as well. Nordea said this week that it has reduced its loans and provisions to shipping and offshore in Q3 by nearly EUR 1.5m vs. Q3 of 2017, leaving them at approximately EUR 8.5 billion at present, also a EUR 300m drop from Q2. The bank saw after-tax earnings EUR 684m in the quarter, albeit about 18% lower than a year ago. DZ Bank is continuing its selloff and break-up plans for DVB Bank. The plan is to first sell DVB’s aviation and land-transport divisions before finding a buyer for its core shipping finance business. Analysts speculate that it may follow a path similar to Commerzbank, which had its shipping core wound down in a series of portfolio sales, loan repackaging and amortisation. The German bank currently holds about EUR 7.2 billion in shipping loans, which is nonetheless down from the EUR 12.5 billion a year ago. German shipping banks have successfully reduced their exposure to shipping non-performing loans (NPLs) of late, says Moody’s Investors Services, noting that their exposure in percentage of Tier 1 capital is now around 60% compared to 100% in 2015.

Want exclusive shipping and shipbroker news on a regular basis?

Subscribe to the BMTI DAILY REPORT today.

Despite an overall widespread buoyant sentiment some brokers are warning that Supra-Ultra rates off the Continent could be facing a downturn from an already comparatively low level. On the other hand, Ultramax tonnage was concluded at US$ 18,000 per day from North France via West Med to West Africa, whilst scrap charterers do not need to pay more than around US$ 13,000 daily for trips into the Med. Handysize tonnage of 37-39,000 dwt has been fixed at US$ 12,000 daily to the ECSA and at US$ 11,000 daily to the US Gulf, respectively. A 37,000 dwt was recently fixed at US$ 12,000 daily into the Med…. Subscribe to the BMTI Daily Report to read the rest of this article.

Would you like to read our shipbroker viewpoint every morning?

Subscribe to the BMTI DAILY REPORT today.

Coal freights on a 52,000 dwt Newcastle/Huangpu

A week of holidays in the Far East had a notable impact on dampening activity throughout the Pacific and Indian Ocean trade areas. Freights, however, remained miraculously solid and, in some cases, even mildly bullish with Pacific rounds fetching upwards of US$ 11,750 daily on modern Ultramax tonnage in the 58-62,000 dwt range. Such rates are as much as US$ 100-200 higher than a week ago, suggesting that charterers are willing to pay a little bit extra if only to secure employment before they rush off to the holidays. Period activity has been somewhat mixed but still present with larger Ultramaxes of 60-64,000 dwt fetching up to US$ 15,500 daily on medium period deals for 4-6 months and 5-8 months of trading on worldwide redelivery. Indonesia rounds were also steady and barely shifted over the past week with the Tess 58 vessels fixing US$ 12,500-12,750 daily spot rates on trips from South China via Indonesia to EC India and as much as US$ 13,000 daily to WC India. Chartering activity is nonetheless subdued, and owners are hoping the week ahead will put an end to the dry spell as brokers and traders return to full business engagement. Like the larger Supramaxes and Ultramaxes, Handysize activity was largely limited and sporadic across the eastern basin with holidays taking some of the blame. Freights were also largely unmoved in the past week with the lack of business contributing to a general holding pattern that kept the market in limbo until traders resumed their work. Freights for 28,000 dwt ships from Southeast Asia to NoPac via Australia continue to achieve about US$ 8,200 daily, just as they did at the end of September.

Would you like to read our shipbroker viewpoint every morning?

Subscribe to the BMTI DAILY REPORT today.

BMTI is pleased to announce publication of the updated and expanded edition of SHORT SEA ON THE MOVE, our industry standard overview of the European short sea market in all its facets and complexities. Boasting a wide range of exclusive information, data analysis, regional studies, trade patterns, orderbook tables, fleet statistics and market forecasts—among much more—this study belongs on the desk of every serious market player in the European coaster industry. ORDER YOUR COPY TODAY

Through all the ups and downs and inter-week volatility, it seems that Capesize freights have finally climbed to new year-to-date highs, proving that the bullishness is hardly a temporary fluke but rather a underlying feature of a newly confident spot market. With China/Brazil RVs reaching US$ 23,000 daily, the highest level this year so far, and the equivalent voyages hitting similar highs of US$ 22.6/mt, this summer is shaping up to be a very generous one for the biggest bulkers. Pacific rounds have seen even stronger improvements of US$ 1,000 at midweek, taking the assessment into the US$ 22-23,000 daily range and giving shipowners cause for celebration.

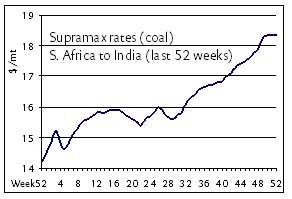

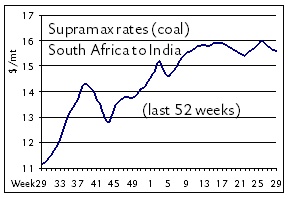

Even as the Pacific Panamaxes lag behind, improvements have been strong enough in the West to add to the BPI reaching its highest level in four months and owners looking for upgrades where they would not have dared just two weeks ago. Robust demand for coal to India, in the midst of monsoon season no less, has contributed to tightening tonnage in the Indian Ocean even as it hasn’t been enough to close the gap on available tonnage yet and drive rates upward. Indo rounds are still fetching US$ 11-12,000 daily on HK delivery to ECI on Kamsarmax tonnage.

Handysizes have been rebounding in the Atlantic basin with average trans-Atlantic freights on 28,000 dwt tonnage reaching the five-digit range of the low-middle US$ 10,000s on ECSA trips to the Continent and up to US$ 12,000 on the same run with 38-42,000 dwt vessels. Handysizes from the USG have been securing high US$9,000s on NCSA redel while the rest of the Atlantic is more hit or miss. Front hauls ex-Black Sea to the Far East have revived of late with US$ 18,500 daily now doable on a Tess 58.

Would you like to read our shipbroker viewpoint every morning?

Subscribe to the BMTI DAILY REPORT today.

The chartering community is closely watching the upward rally in the Black Sea area. Charterers were bidding Ultramaxes US$19,000 daily versus owners testing number of US$ 22,000 daily. Given this, one wonders where this development might lead to. Based on a steady demand, rate levels could reach US$ 30,000 daily, which then in turn would attract ballasters from North Africa and Red Sea, to name just a few areas. Inevitably other areas will benefit such as Continent from where charterers need to pay rates stopping owners from ballasting straight to the Med, which is only a couple of days away. It can be taken for granted that the next reported front haul fixture will be above US$ 20,000 daily. Grain rates to Saudi Arabia for 60,000mt are likely head towards US$ 25/mt. In sharp contrast Supra tonnage can still be fixed at US$ 6,500 daily for a trip to the US Gulf.

From ECSA Ultramax tonnage was traded around US$ 12,500-13,000 daily for a trip to the US Gulf. Supramax rates to the Continent-Med are still disappointingly weak hovering at around US$ 13,000 daily. The front haul runs have been done at rates of around US$ 14,500 daily plus US$ 450,000 BB for Ultramaxes. Tonnage of 35,000dwt has been offered US$ 10,000 daily from North Brazil to the Baltic. From the USG, the Centurion fixture at US$ 20,750 daily to WCCA, if correctly reported, looks like a promising figure and looks as if the market is in the process of changing direction for Ultra-Supramax tonnage. Handysizes are more difficult to cover with tonnage ballasting from the USEC to the US Gulf.

The market in the East has taken a painful direction for owners with nickel ore charterers getting away with rates below US$ 10,000, which is very disturbing. Ultramaxes were traded at around US$ 12,500-13,000 for 4-6 months trading with a lower rate for the first 30 days to reflect the poor spot market. Handysizes are holding steady whilst owners’ bullishness is met with calm by charterers. Despite several owners holding out for US$ 10,500-11,000 for a NoPac RV there is always the possibility to find tonnage of 33-36,000 dwt below US$ 10,000 as happened. CIS charterers were seeing 37,000 dwt at US$ 9,500 daily from North China via CIS to P.I.

Would you like to read our shipbroker viewpoint every morning?

Subscribe to the BMTI DAILY REPORT today.

Black Sea grain producers have been showing mixed results so far this year. An ongoing dry period throughout the region could adversely impact the harvest in 2018 with experts saying it may affect Ukraine’s harvest by as much as 50%. Russia recently revealed that its exports over the past 12-month period amounted to 51.2 Mt, a 48% increase from the previous season. Russia conversely expects to see lower results this year with domestic agriculture agencies estimating the crop will be as much as 15% lower this year than last year due to poor weather conditions. Last year’s 134 Mt harvest was an all-time record and unlikely to be bested in the near term. Reductions in volume this year may be even lower than previously expected with analysts SovEkon having reduced their estimates for the year from 200 Mt to 124 Mt. IKAR reduced its estimates for the Russian grain crop from 117 Mt to 114 Mt.

Strong consumption of coal in Asia has boosted demand for Australian thermal coal this year, this week pushing the spot price for prices at Newcastle to US$ 120/mt FOB, the highest they’ve been in six years. Demand has been brisk to China, which continues to burn coal for power and industry, as well as Japan, which buys 40% of Australia’s total thermal coal exports for its own utilities. The price surge has been further exacerbated by limited supply from mines, many of which have closed or wound down operations in recent years, even as the summer months are demanding more power consumption due to rising cooling requirements around the globe.

The EU is to make a ruling on whether to lift anti-dumping duties on Russian ammonium nitrate following the results of two interim revives on AN duties on Russian exported product last year. The results are expected in early-mid August. At issue is a current duty on Russian AN, which is considered significantly cheaper than European AN, with duties ranging from EUR 24/mt to EUR 47/mt, depending on trade conditions. One argument for lifting the duties would be providing cheaper fertilizer costs for European farmers. The first AN anti-dumping measures were issued in 1995 and have been intermittently reinstated at different periods ever since.

Prices for Turkish scrap imports remained largely stable in the past week after a period of increasing in the last weeks of June. There are reports, however, that at least one buyer of auto bundle scrap increased its buy price to about US$ 331/mt FOB last week.

Looking for more dry cargo-relevant commodity news?

Want to read our shipbroker viewpoint fresh each morning?

Need market-specific analysis from the bulk carrier shipping market?

Subscribe to the BMTI DAILY REPORT today.