Considerably more Capesize fixtures and news of activity bubble up to the surface as the week ends, but nothing consistent or extensive enough to justify a recovery. Indeed, the spot market is as disparate as it has been all week with only long-term period time charterers of any interest to charterers, seemingly, at the moment, with year long durations done anywhere from US$ 18,000 to US$ 20,000 daily on worldwide redelivery. Long haul rates, meanwhile, continue their collapse as Pacific rounds and TARVs each lose nearly US$ 3,000 to settle at around US$ 10,000 daily and US$ 26,000 daily, respectively.

Considerably more Capesize fixtures and news of activity bubble up to the surface as the week ends, but nothing consistent or extensive enough to justify a recovery. Indeed, the spot market is as disparate as it has been all week with only long-term period time charterers of any interest to charterers, seemingly, at the moment, with year long durations done anywhere from US$ 18,000 to US$ 20,000 daily on worldwide redelivery. Long haul rates, meanwhile, continue their collapse as Pacific rounds and TARVs each lose nearly US$ 3,000 to settle at around US$ 10,000 daily and US$ 26,000 daily, respectively.

Renewed support in the Panamax derivatives sphere on Q1 (settling near US$ 11,000) suggests the makings of a bounce next week, brokers are telling us, but for the time being spot freights continue to slide in both East and West. The fact that average Panamax rates closed out 2017 more than 60% than where they started would seem to indicate potential for further gains in the mid-term, if not the short-term.

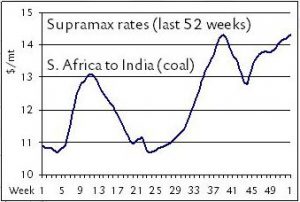

Supramaxes are firing on all cylinders in the Atlantic, particularly from the lively USG market, where owners can now ask for upwards of US$ 25,000 daily for a front haul and stand a good chance of getting it. This is compared low US$ 20,000s available just a week ago. Similarly, trans-Atlantic trips USG/UKC-Med are fetching US$ 22-23,000 daily on DOP. Inter-Continental Handysizes have been securing fertilizers on 38-42,000 dwt ships at rates in the high US$ 7,000s amid rumours of US$ 8,000.

…read more in today’s BMTI Daily Report.